All Categories

Featured

State Farm representatives market everything from house owners to auto, life, and other popular insurance coverage items. State Farm provides global, survivorship, and joint universal life insurance policies - index universal life insurance canada.

State Farm life insurance coverage is generally conservative, supplying steady alternatives for the ordinary American family members. If you're looking for the wealth-building opportunities of global life, State Farm does not have competitive options.

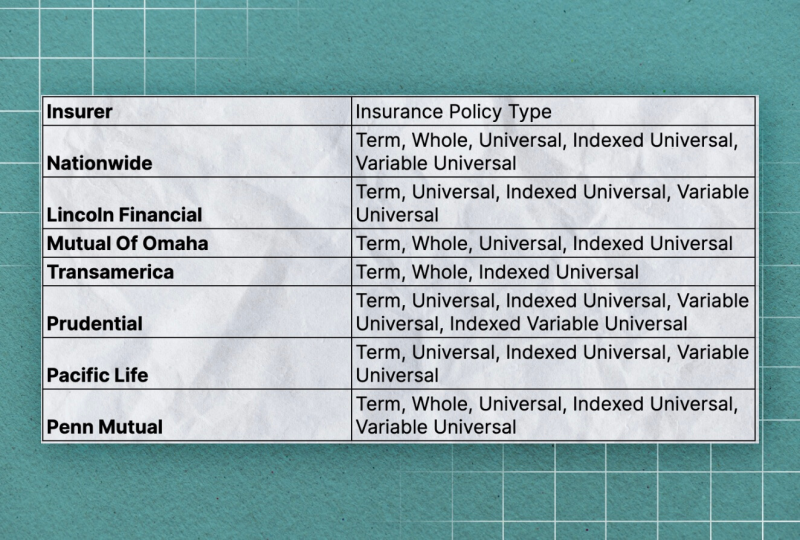

It does not have a strong presence in various other monetary products (like universal plans that open up the door for wealth-building). Still, Nationwide life insurance policy strategies are highly obtainable to American family members. The application process can additionally be much more workable. It helps interested parties get their foot in the door with a reputable life insurance policy plan without the much extra complicated discussions concerning investments, economic indices, and so on.

Also if the worst happens and you can't get a larger plan, having the defense of an Across the country life insurance coverage plan might change a customer's end-of-life experience. Insurance coverage firms use medical examinations to assess your risk course when applying for life insurance policy.

Customers have the choice to alter rates every month based upon life situations. Naturally, MassMutual offers interesting and possibly fast-growing possibilities. These plans have a tendency to carry out best in the lengthy run when early down payments are higher. A MassMutual life insurance policy agent or economic expert can help purchasers make plans with area for adjustments to fulfill short-term and long-lasting monetary goals.

Universal Life Insurance Death Benefit Options

Review our MassMutual life insurance policy evaluation. USAA Life Insurance Policy is understood for using inexpensive and thorough economic products to army members. Some purchasers might be shocked that it offers its life insurance policy policies to the public. Still, military members take pleasure in distinct benefits. Your USAA plan comes with a Life Event Option motorcyclist.

VULs include the highest risk and the most prospective gains. If your plan does not have a no-lapse warranty, you might also shed coverage if your cash money value dips below a certain limit. With so much riding on your investments, VULs need constant attention and upkeep. Because of this, it might not be a wonderful choice for people who simply want a survivor benefit.

There's a handful of metrics through which you can evaluate an insurer. The J.D. Power consumer contentment rating is an excellent option if you desire a concept of exactly how consumers like their insurance policy. AM Best's financial strength rating is another vital metric to take into consideration when choosing an universal life insurance policy company.

This is particularly important, as your cash money worth grows based on the investment choices that an insurance policy firm supplies. You ought to see what financial investment alternatives your insurance policy supplier offers and compare it against the goals you have for your plan. The best method to locate life insurance policy is to gather quotes from as several life insurance policy firms as you can to understand what you'll pay with each policy.

Latest Posts

Adjustable Life Plan

Best Indexed Universal Life Products

Guaranteed Universal Life Insurance Companies