All Categories

Featured

Table of Contents

This plan design is for the client who requires life insurance coverage however would love to have the capacity to choose exactly how their cash money value is invested. Variable policies are financed by National Life and distributed by Equity Solutions, Inc., Registered Broker/Dealer Associate of National Life Insurance Business, One National Life Drive, Montpelier, Vermont 05604.

Then, the insurance company will certainly pay the face amount directly to you and end your policy. Contrastingly, with IUL policies, your death advantage can raise as your cash money value expands, bring about a potentially greater payment for your recipients.

Discover the lots of advantages of indexed global insurance and if this sort of plan is right for you in this insightful short article from Safety. Today, many individuals are taking a look at the value of irreversible life insurance policy with its capability to supply long-term defense in addition to cash money worth. indexed universal life (IUL) has come to be a preferred option in offering irreversible life insurance policy security, and an also higher potential for growth via indexing of interest credit histories.

What is the best Indexed Universal Life Vs Whole Life option?

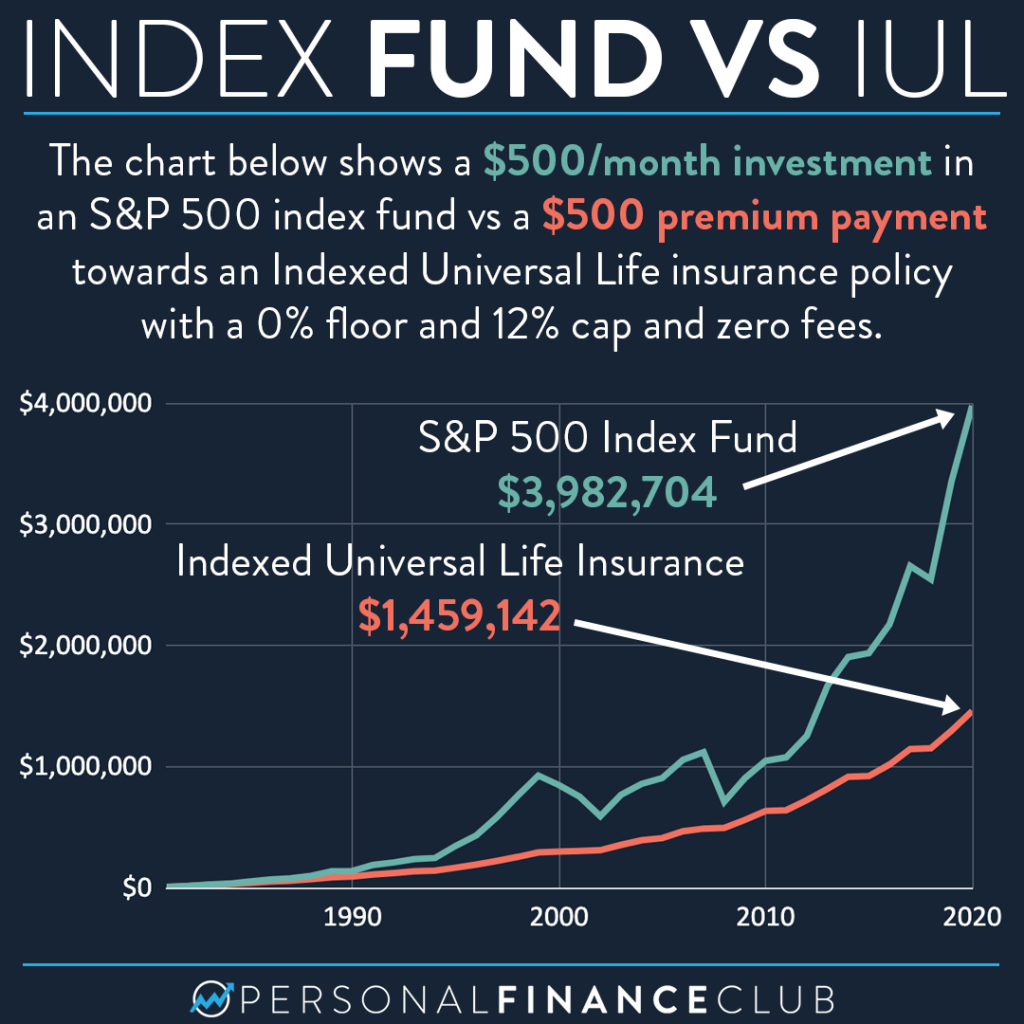

However, what makes IUL various is the means passion is attributed to your plan. Along with using a conventional declared rates of interest, IUL uses the opportunity to make rate of interest, subject to caps and floorings, that is connected to the performance of a picked selection of market indices such as the S&P 500, Dow Jones Industrial Standard or the Nasdaq-100.

With IUL, the insurance policy holder chooses the quantity alloted among the indexed account and the taken care of account. Just like a normal global life insurance policy policy (UL), IUL permits an adaptable premium. This indicates you can pick to contribute even more to your plan (within government tax obligation legislation limits) in order to aid you accumulate your cash money value even much faster.

As insurance plan with investment-like attributes, IUL plans bill commissions and charges. These charges can reduce the money value of the account. While IUL policies additionally offer assured minimal returns (which may be 0%), they also cap returns, even if your choose index overperforms (Indexed Universal Life policyholders). This means that there is a limitation to rate of money worth growth.

Created by Clifford PendellThe pros and disadvantages of indexed universal life insurance (IUL) can be hard to understand, particularly if you are not knowledgeable about exactly how life insurance functions. While IUL is among the best items on the market, it's also among one of the most unpredictable. This kind of coverage may be a feasible alternative for some, yet for many people, there are much better alternatives avaiable.

Where can I find Iul Cash Value?

In addition, Investopedia lists tax obligation advantages in their benefits of IUL, as the death benefit (money paid to your beneficiaries after you die) is tax-free. This is real, however we will include that it is also the instance in any type of life insurance policy, not just IUL.

These add-ons can be bought for various other types of plans, such as term life insurance coverage and non-guaranteed global life insurance policy. The one point you need to learn about indexed global life insurance is that there is a market threat involved. Spending with life insurance policy is a different video game than acquiring life insurance policy to secure your family, and one that's not for the pale of heart.

All UL products and any type of basic account product that depends on the efficiency of insurance companies' bond profiles will certainly be subject to passion price danger."They proceed:"There are intrinsic dangers with leading customers to believe they'll have high rates of return on this product. For example, a client may slack off on funding the cash money value, and if the policy doesn't do as expected, this could result in a gap in insurance coverage.

In 2014, the State of New york city's insurance policy regulator penetrated 134 insurers on exactly how they market such policies out of problem that they were exaggerating the potential gains to customers. After proceeded examination, IUL was hit in 2015 with laws that the Wall surface Street Journal called, "A Dosage of Fact for a Hot-Selling Insurance Coverage Product." And in 2020, Forbes released and short article entitled, "Appearing the Alarm System on Indexed Universal Life Insurance Policy."Despite thousands of write-ups advising consumers about these policies, IULs proceed to be just one of the top-selling froms of life insurance policy in the USA.

Who offers Iul Loan Options?

Can you deal with seeing the supply index execute poorly understanding that it straight impacts your life insurance and your capability to protect your household? This is the final intestine check that prevents also incredibly rich capitalists from IUL. The whole point of buying life insurance policy is to reduce risk, not create it.

Find out more regarding term life below. If you are looking for a policy to last your entire life, take a look at assured global life insurance policy (GUL). A GUL plan is not technically permanent life insurance policy, yet rather a crossbreed in between term life and global life that can enable you to leave a tradition behind, tax-free.

Your cost of insurance will certainly not transform, even as you grow older or if your health and wellness modifications. Your insurance coverage isn't connected to an investment. You spend for the life insurance policy security just, just like term life insurance (IUL vs whole life). You aren't putting additional money into your policy. Depend on the economists on this: you're much better off putting your money right into a savings or maybe paying down your home mortgage.

What is Tax-advantaged Indexed Universal Life?

Surefire universal life insurance policy is a fraction of the cost of non-guaranteed global life. You don't risk of losing insurance coverage from unfavorable investments or modifications in the marketplace. For a comprehensive contrast in between non-guaranteed and assured global life insurance policy, click here. JRC Insurance Coverage Group is here to help you find the best policy for your needs, without any added price or fee for our support.

We can get quotes from over 63 top-rated providers, permitting you to look beyond the big-box firms that commonly overcharge. Consider us a buddy in the insurance coverage industry who will look out for your best passions.

Is there a budget-friendly Iul Investment option?

He has aided hundreds of family members of businesses with their life insurance needs given that 2012 and specializes with candidates that are much less than best wellness. In his spare time he enjoys hanging out with household, traveling, and the open airs.

Indexed universal life insurance policy can assist cover numerous financial needs. It is simply one of numerous kinds of life insurance coverage readily available.

Latest Posts

Adjustable Life Plan

Best Indexed Universal Life Products

Guaranteed Universal Life Insurance Companies